NZS3910 Contracts: Covid-19 renders “Working Day Rate” inequitable

The question has been raised “would it be clearly inequitable to use the Working Day Rate with Covid-19 related Suspension of Works for the Level 4 Lockdown per 9.3.12?”. The answer to this NZS3910:2013 Contract form related question is YES, but the rationale and result is not what you might be expecting.

When considering the criteria to be explored when abandoning the Working Day rate for inequitable reasons, consideration of whether the working day rate is high or low compared to actual daily rated costs alone is not the prescribed test, even though such a comparison is required [9.3.11(c)] when the prescribed test [in 9.3.12] is applied [in 9.3.11(b)] and confirms an inequitable outcome. The prescribed test is to consider “the nature or the circumstances of the variation” are such that it clearly would be inequitable [9.3.12].

NZS3910 makes provision for suspension of the works as a variation allowing the day rate to apply. So, a total shutdown scenario for a specific project has been contemplated, as has the normal variation EoT where there is a critical path delay but the project continues on no-critical path items.

The Working Day Rate is pre -calculated to reflect events the parties commonly contemplated. A project only shutdown is close to 100% of the full actual day expense, except all trade labour can be re-allocated to other projects. Subcontractors are always running behind somewhere else. But with Covid-19, no-one contemplated a world-wide shutdown of all travel and all business such that there is no work and no income anywhere. On this basis it would be clearly inequitable for the Contractor to claim the Working Day Rate that is calculated on an entirely different set of assumptions because “the nature or the circumstances” of the variation give rise to an extreme under recovery of Contractor Off-site Overheads.

The Components of Off-site Overheads and Profit

Off-site Overheads and Profit are usually applied as a single percentage to all other project costs but in NZS3910 is defined as in three distinctive sub-parts:

“NZS3910:2013 states: OFF-SITE OVERHEADS AND PROFIT means the following expense or loss not incurred on the Site which are required for the general overall running of the Contractor's business, and which are not required for the carrying out of the Contract Works or for off-Site manufacturing or fabrication work by the Contractor:

(a) General administrative, financial and overhead expenses incurred in the Contractor's head office or other established offices

(b) Executive direction and supervision by principal officers of the Contractor not assigned in the ordinary way to the contract

(c) Profit, other than return on investment on Plant which would normally be recovered in hire rates for Plant.”

Both (a) and (b) above are “time related overheads” per 9.3.11 and (c) is a turnover related entitlement. The fact that we mix these three components into a single percentage is OK when it serves normal business operations where the company recovers enough overheads across all its projects. But when everything stops Under Covid-19, and turnover is non-existent, a percentage recovery does not generate enough money for the company to carry out its General administration & Executive function.

Example of Off-site Overhead vs Profit working day rate recovery disparities

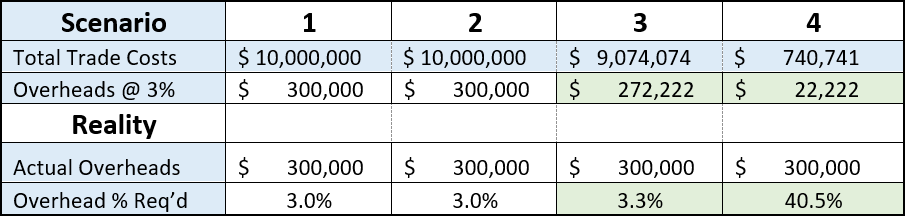

Consider a sample company continuously running 10 projects, each turning over an average of $1,080,000 per month, providing a company monthly cashflow of $10,800,000 per month. P&G (On-site Overheads) is a lump sum (8% proportionally of Specialist trade costs) and Off-site Overheads and Profit (OH+P) is calculated as 8% of all trade costs. To demonstrate the inequity of the Working Day Rate, it is necessary to breakdown OH+P to its constituent parts of (a) & (b) Off-site Overheads which is a time related expense calculated @ 3% proportionally of all trade costs and (c) Profit is value related and calculated @ 5% of all trade costs. In the table below we show the sample company turnover in 4 scenarios.

Scenario definitions:

Scenario 1 - Monthly company turnover for 10 projects all running on time

Scenario 2 - 9 projects per Scenario 1, 1 project 1 month critical path delay

Scenario 3 - 9 projects per Scenario 1, 1 project 1 month suspension delay

Scenario 4 - 0 projects per Scenario 1, 10 projects 1 month suspension delay (Covid-19)

Specialist Trade Cost Turnover in:

Scenario 1 – 100% - Specialist Trades fully engaged on 10 projects

Scenario 2 – 100% - Specialist Trades fully engaged on 10 projects

Scenario 3 – 90% - Specialist Trades fully engaged on 9 projects here and 1 project elsewhere

Scenario 4 – 0% - Specialist Trades fully engaged on ZERO projects anywhere

P&G Trade 8% (On-site Overhead) Cost Turnover in:

Scenario 1 – 100% - BAU

Scenario 2 – 100% - 90% BAU + 10% Working Day Rate applied to 1 project

Scenario 3 – 100% - 90% BAU + 10% Working Day Rate applied to 1 project

Scenario 4 – 100% - 0% BAU + 100% Working Day Rate applied to 10 projects

OH 3% (Off-site Overhead) Cost Turnover in:

Scenario 1 – 100% - BAU

Scenario 2 – 100% - 90% BAU + 10% Working Day Rate applied to 1 project

Scenario 3 – 90.7% - Fails to recover 3% of Specialist Trade turnover on 1 Projects

Scenario 4 – 7.41% - Fails to recover 3% of Specialist Trade turnover on 10 Projects.

Off-site Overhead recovery is time related and its value does not diminish proportional to turnover in the short term. Recovery on a % of turnover value alone is inequitable where turnover declines during a project by effect of variation.

Profit 5% recovery on all Turnover in:

Scenario 1 – 100% - BAU

Scenario 2 – 100% - 90% BAU + 10% Working Day Rate applied to 1 project

Scenario 3 – 90.7% - Fails to recover 5% of turnover on 1 Project for (a) Specialist Trade (acceptable) and (b) Off-site Overhead recovery (Unacceptable)

Scenario 4 – 7.41% - Fails to recover 5% of turnover on 10 Projects for (a) Specialist Trade (acceptable) and (b) Off-site Overhead recovery (Unacceptable)

Profit is always recovered proportional to turnover. Non-recovery because turnover has equitably reduced is acceptable.

Differentiating Off-site Overheads from Profit for recovery purposes

We commonly treat Off-site Overheads and Profit as a single combined % of turnover.

NZS3910:2013 references to the distinction between “Off-site Overheads” and “Profit” can be observed in the definition (above), and clauses 9.3.11, 9.3.13, 9.3.14. 10.3.6, 12.9.3, 12.11.3, Guidelines: p137 Net Cost, Off-site OH+P & On-site OH, p153 G9.3.11 – G9.3.12 & G9.3.14, p171-173 Value of Variations Flow Chart.

Our sample company is entitled to recover $30,000 for Off-site Overheads per project per month of suspension regardless of it being a single project suspension or an all project suspension. In the Covid-19 Scenario 4, the sample company is under recovering 90.7% Offsite Overheads using a Working Day Rate or a % of turnover basis.

9.3.11 (b) is shortened to “The Contractor shall be entitled to a reasonable compensation for time-related Off-site Overheads” becomes operative when the “clearly inequitable” test in 9.3.12 is applied as required in 9.3.11(a).

Calculating the claims

When you recognise Off-site Overheads as a time related cost that accrues at a consistent rate as time passes, when project turnover varies so too does the recovery of Off-site Overheads. It could be argued Scenario 3 was contemplated by NZS3910:2013 and a 10% reduction in overhead recovery is the Ying to the Yang of a 10% increase in value of the contract price that does not extend the completion date of the project. Using a working day Rate for a single project suspension is not necessarily inequitable.

When faced with a shutdown of all projects simultaneously, your Off-site Overhead expenses are not equitably recovered with either the Working Day Rate or % of turnover method, but a form of “reasonable compensation” is an entitlement per 9.3.11(b).

If you have a question or a point of view to share, please contribute to this discussion. Thank you.

See also "Offsite Overhead Recovery Mission"

By Matthew Ensoll

Life Member NZIQS. Reg.QS.

Editor New Zealand Building Economist.

Commenti